There are a lot of factors which can influence your credit score. Student loans, bank loans, payday loans, mortgages, credit cards, divorce, a history of bankruptcy, charge-offs and auto loan payments can all affect your credit score and leave you with bad credit, or at least credit which isn’t as good as it could be. For many people, low credit scores have been the main barrier they have to get over in order to access basic modern services, placing items like cosmetic surgery beyond their reach. Today, companies in this space are working to reverse this trend, giving even consumers with less than ideal credit access to bad credit loans which finance plastic surgery and other medical goods and services.

How do I get funding for plastic surgery?

According to the American Society for Aesthetic Plastic Surgery, the average cosmetic procedure can cost anywhere from around $400 for Botox to over $25,000 for a complete “mommy makeover,” amounts which most people don’t usually have on hand in their bank accounts. Many people turn to their insurance provider as the first option for obtaining cosmetic surgery. However, insurance plans often limit access to cosmetic procedures or deny claims for aesthetic plastic surgery outright. Some people use credit cards or their checking account contents to pay for plastic surgery. If you can wrap your head around various credit card jargon and clauses, you can go with this option. But credit cards often have a high-interest rate after the introductory period and depleting one’s checking account leaves no way to pay other expenses. For these people, a medical care loan might be the best option.

Can I get financing for plastic surgery with bad credit?

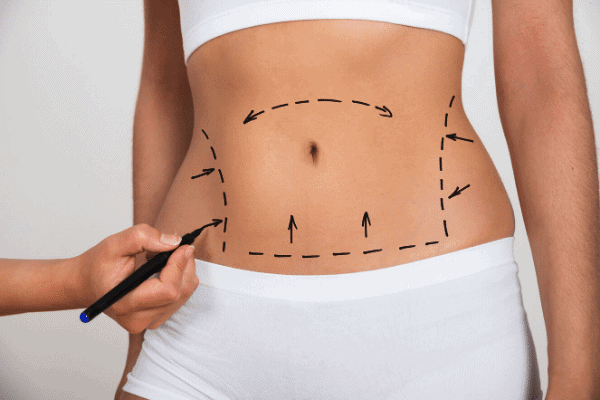

Companies in the financing space are working to make aesthetic surgeries such as breast reduction, breast augmentation, breast implants, eyelid surgery, a nose job or tummy tuck more accessible, even to people with poor credit. With installment loans up to $35,000 at competitive rates and reasonable monthly payments, and direct balance transfers available to in-network providers, medical online lender networks can help safeguard your savings account and help you rebuild your credit while you cover plastic surgery. Even better, you can often receive approval in as little as one business day.

Do plastic surgeons have payment plans?

Some cosmetic and plastic surgeons do offer in-house financing options in addition to or besides your health insurance. However, the terms vary widely and patients are strongly cautioned to read the fine print of any payment plan or personal loan, including those offered by a plastic surgeon, to ensure the terms are reasonable and won’t hurt your credit. When your bank or credit union won’t give you a health care or cosmetic surgery loan because of low credit scores, it doesn’t hurt to ask what your plastic surgeon’s payment options are so you have a complete picture of what your personal finance situation will look like with plastic surgery loans and without them.

Can you finance breast implants with bad credit?

Once you apply and are approved for loans for plastic surgery, what you use the loan amount for is up to you, since the entire point of the loan is to help you pay for plastic surgery with bad credit. Your plastic surgeon receives compensation without you needing to hassle with insurance claims, and a loan bad credit clients can afford often has a lower interest rate than credit cards. A plastic surgery procedure can be expensive, but surgery financing helps make cosmetic surgical procedures more affordable, letting you live your life instead of worrying about how you’re going to pay your cosmetic surgeon. If you’re interested in plastic surgery without fear of how you’re going to pay for it, loan brokers and credit providers are ready to help you put your best face forward.

Throughout the year, our writers feature fresh, in-depth, and relevant information for our audience of 40,000+ healthcare leaders and professionals. As a healthcare business publication, we cover and cherish our relationship with the entire health care industry including administrators, nurses, physicians, physical therapists, pharmacists, and more. We cover a broad spectrum from hospitals to medical offices to outpatient services to eye surgery centers to university settings. We focus on rehabilitation, nursing homes, home care, hospice as well as men’s health, women’s heath, and pediatrics.